Get a quote

Fill in the relevant proposal form to receive a quote.

Make a claim

Guidance on how to report a claim.

Talk to our experts

Contact us at ITIC.

+44 (0)20 7204 2928

Positive Signs

One of the unfortunate effects of a period of economic instability is that companies can lose money, to which a common reaction is to try to find another party to blame. The result is that professional indemnity insurers see a rise in both the number and value of claims, and this has been ITIC’s experience in the years 2009 to 2011. Encouragingly, there are now positive signs that the steps taken in response to this recent claims inflation are starting to appear in ITIC’s financial statements. Combined with a 7.5% investment result for 2012, and the related two year policy continuity credit (or dividend) for 2013 of 7.5%, the indications are that we are now coming through this difficult period.

Combined Ratio Development

In the 2012 Year Book, we introduced readers to the combined ratio insurance statistic. This is always worth reviewing for any insurance company as a measure of overall performance as it is the proportion of top line premium income absorbed year on year by an insurer’s claims and operating expenses. It is not uncommon for many insurers to operate permanently with a ratio exceeding 100%, using their financial reserves or investment income to make up any shortfall. This is not ITIC’s underwriting strategy, where a more prudent approach is taken.

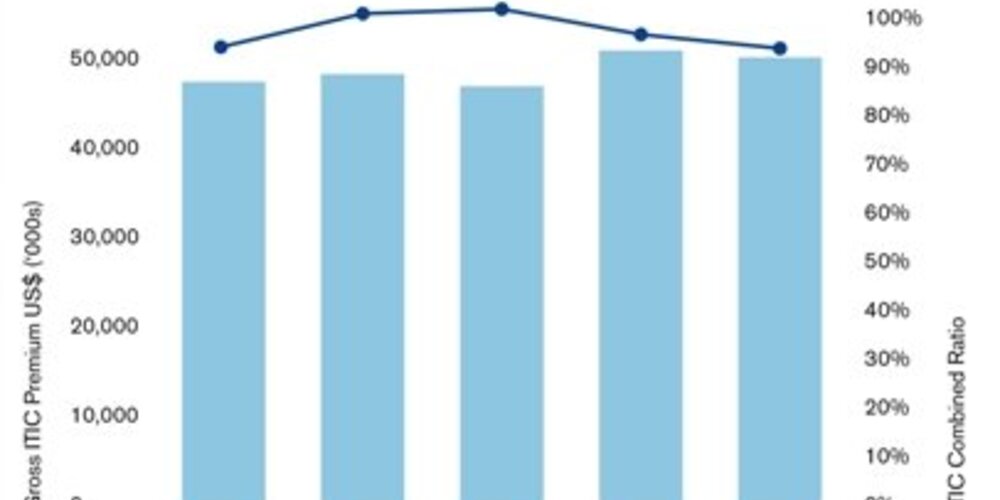

A graph illustrating the trend of ITIC’s combined ratio over the last five years is shown above. You will see that whilst the overall premium level remains stable, the combined ratio trend continues to fall, moving below 100% once again.

Risk Sharing

A part of ITIC’s underwriting strategy over the last three years has been to ask those members unfortunate enough to have regular claims to retain some more risk themselves, or risk share, by taking a higher deductible. This mirrors what ITIC has done with its reinsurance, those insurance contracts purchased to protect ITIC against major claims, where ITIC’s retention has risen steadily over the period 2010 – 2013. As ITIC grows in size and strength, sharing some more risk so as to keep reinsurance costs at a reasonable level is only prudent.

Loyalty

It is only right and proper that members’ loyalty to ITIC through this difficult period is noted and recorded here. Your support, as well as that of the large number of your insurance brokers, has allowed ITIC to maintain, and develop, a strong solvency position well above any regulatory requirement. We are also quite rightly proud of the 95% of ITIC members who choose to renew their insurance every year, as well as the fact that 65% of ITIC members renew on a two year basis.

Additional Products

All members and insurance brokers should be aware that ITIC offers a range of insurance products in addition to specialist marine and transport professional indemnity insurance. Income protection for shipbrokers and ship managers; cash in transit or office and money insurance; legal costs cover relating to debt collection; and for more personal professional protection, directors’ and officers’ insurance, are all available from ITIC. Please do ask your insurance broker or ITIC underwriter for a quotation for one of these additional products.

Thank you to all ITIC members, and their insurance brokers, for your ongoing support for ITIC in 2013.