Get a quote

Fill in the relevant proposal form to receive a quote.

Make a claim

Guidance on how to report a claim.

Talk to our experts

Contact us at ITIC.

+44 (0)20 7204 2928

| Combined ITIC and TIMIA Financial Highlights for the year ended 31st May 2023 | Year end May 2023 | Year end May 2022 |

|---|---|---|

| US$ '000s | US$ '000s | |

| Gross premiums written | 68,545 | 65,672 |

| Reinsurance premiums (excess loss) | (5,303) | (5,365) |

| Claims incurred less excess loss reinsurance recoveries | (18,109) | (8,517) |

| Operating expenses | (22,347) | (23,444) |

| Operating result for the year before continuity credit, investment result and exchange result | 22,786 | 28,346 |

| Continuity credit | (14,586) | (14,201) |

| Operating result for the year before investment result and exchange result | 8,200 | 14,145 |

| Combined ratio (pre continuity credit) | 67% | 57% |

| Combined ratio (post continuity credit) | 88% | 78% |

| Investment result (realised and unrealised) | (144) | (6,253) |

| Taxation | 40 | 122 |

| Surplus for the year | 8,096 | 8,014 |

| Free reserves brought forward at 1st June | 221,918 | 213,904 |

| Free reserves carried forward at 31st May | 230,014 | 221,918 |

| Free reserves: | ||

| Assets under management including accrued interest | 307,921 | 298,076 |

| Other net assets | (9,714) | (7,168) |

| Less: Outstanding claims reserves net of reinsurance recoveries | (68,193) | (68,990) |

| Free reserves carried forward at 31st May | 230,014 | 221,918 |

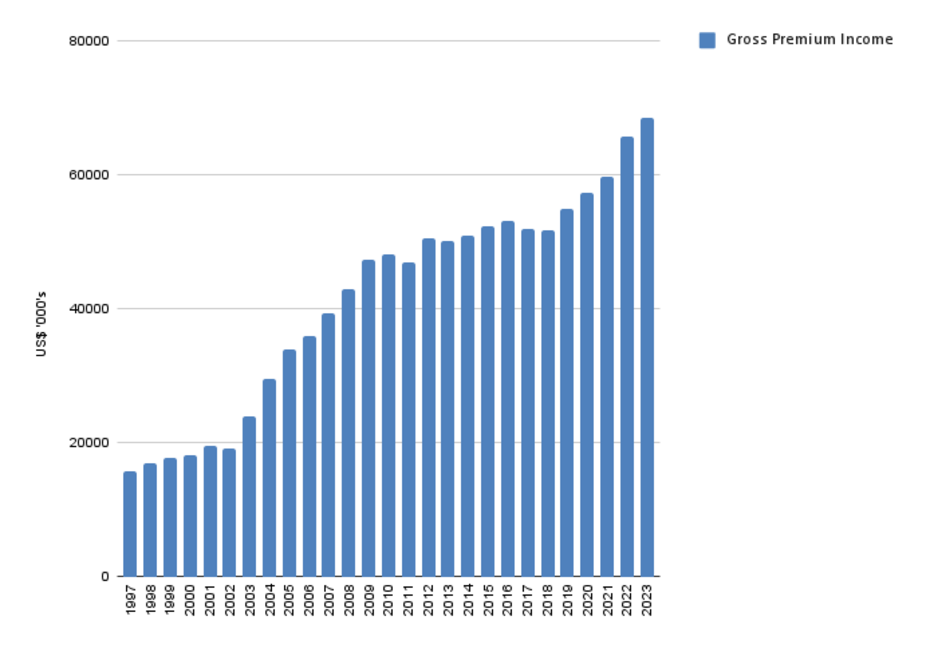

The following graph shows the growth in premium income of ITIC for the years ended 31st May:

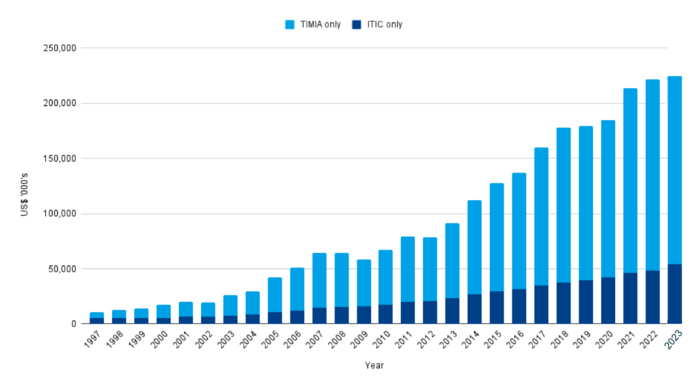

The reserves of the combined club at 31st May continue to grow through a strong investment performance and stable underwriting